Vision

We are the Bank of Choice driven to

fulfill your changing needs.

Mission

Aiming to be better everyday

Committed to provide to the:

| Customers | best experience |

| Employees | winning culture |

| Owners | outstanding returns |

| Community | responsive organization |

Core Values

Concern for the Individual

Excellence

Leadership

Teamwork

Integrity

Change

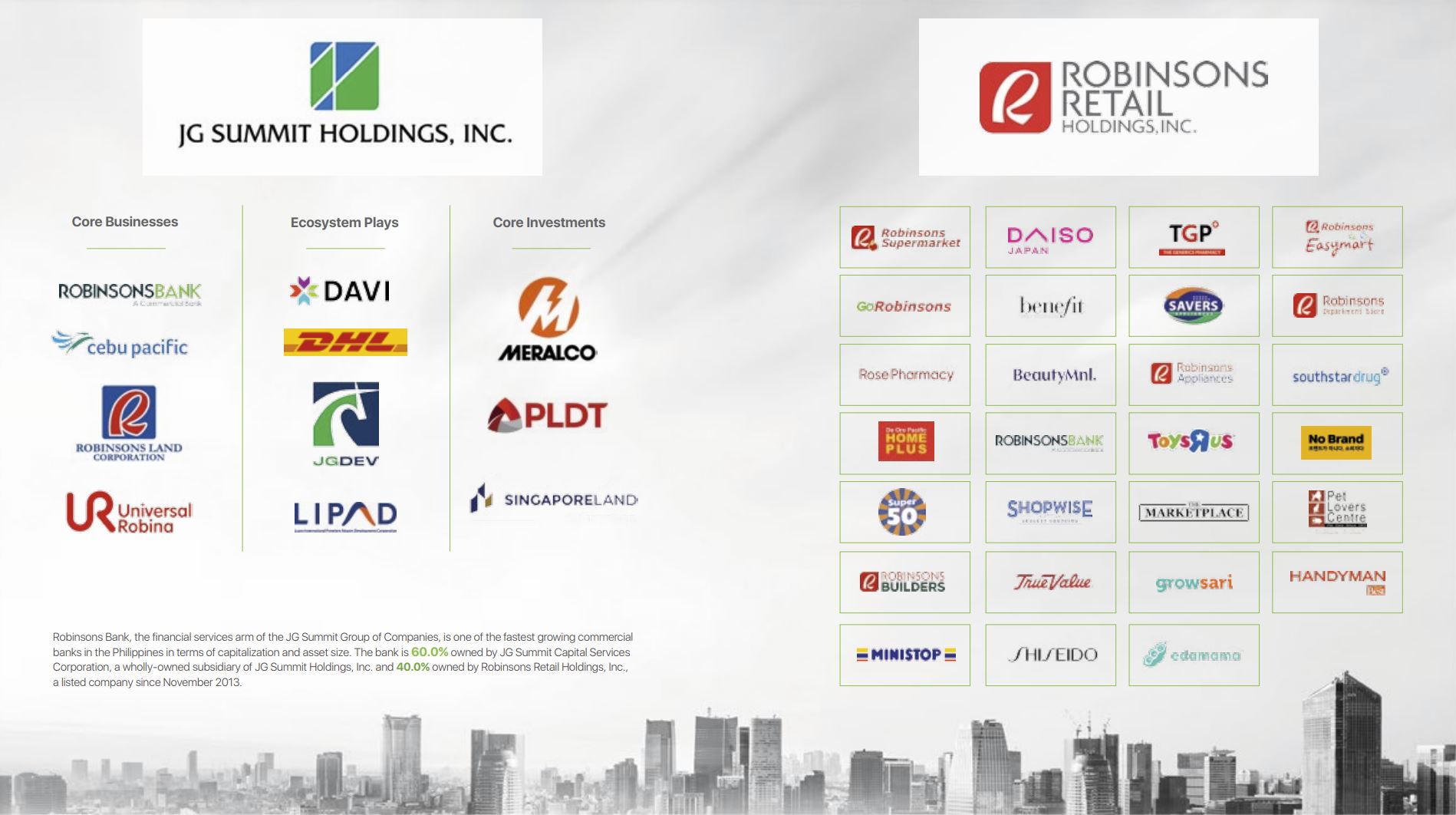

Robinsons Bank, the financial services arm of the JG Summit Group of Companies, is one of the fastest growing commercial banks in the Philippines in terms of capitalization and asset size. The bank is 60.0% owned by JG Summit Capital Services Corp. and 40.0% owned by Robinsons Retail Holdings, Inc., a listed company since November 2013.

History - Milestones

Robinsons Bank started as a savings bank in November 1997 amid the backdrop of the Asian financial crisis. In 2002, then Robinsons Savings Bank acquired the branches of ABN Amro Savings Bank (Philippines), its licenses to operate the branches and bank deposit portfolio. This acquisition made Robinsons Savings Bank the seventh largest thrift bank during that period.

In February 2010, Robinsons Savings Bank acquired the controlling interest of the Royal Bank of Scotland (Philippines). In August of the same year, Royal Bank of Scotland (Philippines) was renamed as Robinsons Bank Corporation. Then by December, Bangko Sentral ng Pilipinas (BSP) approved the merger of Robinsons Savings Bank and Robinsons Bank Corporation, with Robinsons Bank Corporation as the surviving entity. With this merger, Robinsons Bank became the 14th largest amongst commercial banks and the 31st largest bank in the Philippine banking system at that time.

In 2012, BSP approved the Bank's move to acquire Legazpi Savings Bank (LSB). The acquisition of LSB opens up business lines and grows the target market for Robinsons Bank in the Bicol region. LSB became a wholly-owned subsidiary of Robinsons Bank.

The bank rolled out its strategic plan Roadmap 2020 in 2015, with an initial phase of capacity building. During its second phase focused in core income growth in 2016, the bank launched its Visa Debit Card which benefits its customers with convenience and better security.

By 2017, the bank oversubscribed its first Long-term Negotiable Certificates of Deposits (LTNCD) of Php4.1B. The launch of the Robinsons Bank UNO® and DOS® Mastercard in the same year marked its entry into the credit card business, as part of its expansion of its product portfolio. With the convenience of technology and digitalization, the bank developed the Personal Online Banking (POB) Web and the POB Mobile Application for banking to be more accessible to the bank’s clients.

20 Years of Excellence

Robinsons Bank’s 20 years of excellence has performed a momentous leap through its people, processes, products and policies. Over two decades, the Bank takes pride of its sustained growth momentum, following the successful implementation of its strategies. The robust developments and achievements in 2017 are testaments of the Bank’s sustained determination to be among the top banks in the country. Steered by its five-year strategic thrust Roadmap 2020, the Bank completed another milestone alongside the strong domestic economic performance with major initiatives still in the pipeline.

The bank has maintained a brand philosophy of commitment to the community for over 20 years – a drive of fulfilling its customers’ changing needs. In line with JG Summit Conglomerate’s endeavor of leading the country to global competitiveness and making life better for every Filipino, the institution continues to uphold its aim to be better every day.

The financial organization mounts on the vision of being the Bank of Choice and carries on initiatives of creating opportunities for more people to experience the rewards of having a bank that takes care of their needs. Through its dedication to provide the best experience, winning culture, outstanding returns, and as a responsive organization, the Bank embraces and extends more than just being a financial arm but builds relationships beyond banking.

In 2017, motivated by the strong financial results from the previous year, the Bank raised Php 4.18 billion from its first long-term negotiable certificates of deposit (LTNCD) issuance. This is a huge milestone for the bank in its debut to the debt capital market. With this, Robinsons Bank’s LTNCD has been listed on fixed income trading platform Philippine Dealing and Exchange Corporation (PDEx).

The bank entered into the credit card business by launching the Robinsons Bank UNO® and DOS® Mastercard in the same year. Aligned with the Roadmap 2020, the bank also started adapting digital strategies to support the Bank transform from a service organization to a customer-centric sales organization. The bank jumpstarted with the upgrade of the Robinsons Bank Personal Online Banking (POB) Web and the launch of the POB Mobile App in November 2017.

Robinsons Bank is the 19th largest bank in terms of Assets, 18th in terms of Total Loan Portfolio, and 19th in terms of Deposits, amongst the 43 commercial and universal banks in the Philippines as of 2017.

Business Model

In 2020, the Bank launched a new 5-year strategic initiative, Roadmap 2024, which aims to position the Bank among the Top 11-13 Philippine banks in terms of assets by 2024, via organic growth. Through this roadmap, the Bank aspires to deliver targeted and tailored customer experience to accelerate acquisition and drive retention; expand distribution networks efficiently and cost-effectively to reach broader markets; strengthen organizational structure to support rapid growth; accelerate digital transformation and develop strong digital technology that drives innovation; and develop a strong RBank brand.

Amid the global health crisis that struck in 2020, RBank continued to prove its agility and resilience as it was able to quickly adapt and innovate its products and services to remain responsive to the needs of its customers. Robinsons Bank continued to gain recognition for its growing performance and digital innovation including: Service Innovation of the Year (RBank Sign Up) and Consumer Finance Product of the Year (GO!Salary Loan Online) from the Asian Banking and Finance Retail Banking Awards; Most Innovative Digital Banking Services from The Global Economics and Global Business Review Magazine; and Best Commercial Bank, awarded by the International Business Magazine and World Economic Magazine.

Driven by its vision and mission, Robinsons Bank will continue to innovate by developing new products and services and accelerating its digital transformation initiatives, to provide better customer experience and to support growth.